Compliance Areas

Click each link for quick access to the subject:

- Operational Compliance (Depot Inspections)

- Refund Compliance

- Uniform Code of Accounts (UCA) Compliance

- Quality Control Compliance

- Point of Return

- Appealing a Compliance Fee

Customer Experience

The success of Alberta’s beverage container recycling system is heavily dependent on the customer’s experience at your depot.

Operational Compliance (Depot Inspections)

The BCMB has established minimum requirements for the permitting and operation of a depot. The enforcement of these requirements ensures the building of consistent standards for the depot network that stakeholders, such as the government and the public, can rely on.

As per the Depot By-law, Depot Inspections focus on:

- facility

- equipment

- yard and premises

- customer amenities

- hours of operation

To learn more about Operational Compliance: Watch Video!

For more information, please click the links below to review the following documents:

The BCMB has introduced a Depot Performance Evaluation process to the depot network. Replacing the former depot self-inspection program, the new evaluation process features several performance categories and provides a complete review of a depot’s performance over the previous 12 months of their assessment period. Depots are assessed for areas of success and compliance with the following:

- Quality Control Framework

- Refund Compliance Framework

- Operational Compliance Framework

- Non-Beverage Container Compliance Framework

- Uniform Code of Accounts Compliance Framework

- Investigative Processes

- Customer Complaints

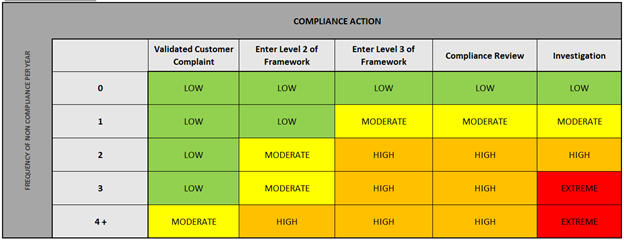

Additional inspections will be conducted where necessary according to the Risk Assessment Matrix below:

Annual depot inspections are important to the BCMB as they allow Compliance Officers to develop and maintain relationships with depot operators and provide a convenient opportunity for depot operators to pose questions and ensure quality service to the public is attained.

The BCMB’s goal is for visits by Compliance Officers to be positive interactions while still ensuring non-compliance with regulation, by-law and policy issues are addressed immediately to protect other depots and the entire industry.

BCMB Compliance Officers visit most depots on an annual or as-needed basis. Compliance Officers use the Inspection Form to evaluate whether or not a depot is meeting the minimum standards as identified in regulation and in BCMB’s By-laws.

Non-Compliance Process

There are many different types and locations of depots in Alberta. Meeting a standard may look different for one depot compared to the next. However, in order to operate in Alberta, a depot must meet all the minimum standards defined by the BCMB.

- If the Compliance Officer has noted any area that does not meet the minimum standard, those areas will be communicated to the depot at the time of the inspection and with a follow-up letter through the industry email account.

- It is important for Permit Holders to address all areas of non-compliance immediately and/or within the time frame agreed to by the BCMB Compliance Officer.

- Compliance Officers work with depots to resolve issues in a time frame that is reasonable and fair to both parties involved.

- It is important for a depot to remain in communication with its BCMB Compliance Officer.

- Repeated non-compliance and/or failure to meet minimum standards may result in escalating consequences, or suspension and cancellation of a depot operating permit.

Compliance Officers are well informed on industry standards, best practices and industry initiatives. Please do not hesitate to contact a Compliance Officer to learn more about any Compliance Program or BCMB standard. To contact a Compliance Officer, click the link below to be redirected to the BCMB Contact Page:

Refund Compliance

All depots are audited by a third-party contractor through the BCMB’s Refund Compliance Program. Regulation requires depots to provide a minimum refund of $0.10 for all registered beverage containers that are 1L or less and a minimum of $0.25 for all registered beverage containers that are over 1L.

Customer confidence and the reputation of Alberta’s beverage container recycling system are heavily influenced and enhanced by depots providing accurate refunds.

Audit Resulting in Non-Compliance

An audit is considered non-compliant if the refund paid by the depot is at a variance worse than -3% of the expected (actual) refund value for that order.

- In the case of non-compliance, the depot enters Level 1 of the Refund Compliance Framework and will receive a second audit within 180 days.

- If the second audit results in non-compliance, the depot enters Level 2 of the Refund Compliance Framework, pay a $400 compliance fee and will receive a third audit within 180 days.

- If the third audit results in non-compliance, the depot will remain in Level 2 of the Refund Compliance Framework, pay a $400 compliance fee and will receive a fourth audit within 180 days.

- If the fourth audit results in non-compliance, the depot enters Level 3 of the Refund Compliance Framework, pay a $400 compliance fee and will receive a fifth audit within 60 days.

- If the fifth audit results in non-compliance, the depot may be referred to the Complaints Director for further action.

Challenging an Audit

A depot may challenge a Zone 2 (variance worse than -3%) audit report in writing within seven days of receiving the audit results. To challenge an audit, a Quality Monitoring System ticket must be submitted. Any challenge received outside of the seven-day challenge period will be considered invalid. Click the link below to be redirected to the Quality Monitoring System:

To avoid compliance action, the BCMB encourages depots to make every effort to provide each customer with an accurate refund.

Click the link below to contact a BCMB Compliance Officer:

Uniform Code of Accounts (UCA) Compliance

Uniform Code of Accounts (UCA) is an integral component of the beverage container recycling system. Completion of the UCA is mandatory as the operational and financial data submitted from each depot in Alberta is used to assist the Data Collection Agent (DCA) in recommending handling commissions. To learn more about the UCA and how to complete it, please contact the Data Collection Agent using contact information found at the link below:

UCA Process and Compliance

Uniform Code of Accounts (UCA) compliance is governed by the Depot By-law. Click the link below to be redirected to the BCMB Governing Documents page to view the by-law:

Process:

- Each year depots will be emailed a UCA package from the Data Collection Agent (DCA). The DCA is the third party contractor hired to collect, analyze and report on UCA information for the purposes of determining handling commissions. The DCA will email depots a UCA package, including a series of forms and an UCA Instruction Manual approximately five months before the filing deadline.

- Please take time to review these documents well ahead of the filing deadline. Many depots use accountants to assist in the completion of these documents. Supporting financial information, such as tax filings, need to accompany your UCA, so it may make sense to complete the UCA at the same time as you complete your annual taxes.

Filing Deadlines:

- Every depot is required to file a UCA annually.

- A depot must submit a fully complete and satisfactory UCA to the Data Collection Agent no later than six months after its year end. For example: If a depot’s year end is December 31, then the UCA needs to submitted no later than June 30 of the following year. It is highly recommended that a depot submit its UCA prior to the last day of its filing period to provide the DCA with time to verify the submission. A UCA is not considered submitted until it has been deemed acceptable by the DCA.

- To be considered submitted:

- the entire UCA document must be filled out, with all appropriate information, and that information must be accurate and verifiable

- all supporting documents must be included in the submission

- the UCA must be signed

- To be considered submitted:

Grace Period:

The Depot By-law provides for a 7-day grace period before the BCMB issues a compliance fee for non-compliance. This grace period does not serve as an extension to the deadline for filing a UCA but provides the DCA a period of time to verify the UCA and communicate with the depot should there be any errors or missing information.

To contact the DCA, click the link below to be redirected to the BCMB Contact Page:

Quality Control Compliance

Audit Summary Results (ASRs) are the results of audits conducted on shipping containers that are shipped to the Collection System Agent (also known as the ABCRC) from depots.

- ASRs show the expected count versus the actual count of a depot’s shipment, as well as any non-beverage containers, refillable beverage containers and non-deposit beverage containers that were included in the shipping containers.

- Zones are used to label the relative success of a depot in shipping accurate quantities of beverage containers. Each zone corresponds to a specific range of positive and negative variances between the reported number of containers shipped on individual shipments by depots and the actual number of containers shipped as verified through the count process carried out by the CSA. The zone ranges are:

- Zone 1: > 0.0% to ≤ 2.5%

- Zone 2: > 2.5%

- All Zone 2 audits are issued to a depot through the Quality Monitoring System (QMS). Each QMS ticket is emailed to the depot’s industry email account. Please monitor your industry email account each day your depot is in operation.

To learn more about Quality Control Compliance: Watch Video!

For more information on the Quality Control Framework, audits and audit challenges, click the link below to be redirected to the Depot Notice page where you will find a notice, dated March 18, 2021, explaining these items in detail:

A depot will enter Level 1 of the Quality Control Framework when:

1. A depot’s average variance per bag audited over a three-month period exceeds any of the following thresholds:

- 1.7% for all containers 0-1L; and/or

- 3.5% for all containers Over 1L; and/or

- 2.0% for all containers

2. Any material stream variance, in any one audit, is greater than 7%

If depot performance does not improve, movement through the Quality Control Framework can lead to further audits and compliance action enforced by the BCMB. If depot performance improves, the depot can move out of the Quality Control Framework.

For more information on the Quality Control Framework, click the links below to be redirected to the BCMB Governing Documents page where you will find the Depot By-law:

For more information, please contact a BCMB Compliance Officer by clicking the link below:

Depots receive Audit Summary Results through the Quality Monitoring System (QMS). To challenge an audit, please see the following information:

- An audit can be challenged through the QMS. Responding to a QMS ticket that contains the original ASR is the only way to challenge an audit.

- All QMS tickets are sent to a depot through its industry email. Please ensure email is reviewed each day your depot is in operation.

- A depot must indicate its intent to challenge an audit within one depot operating day from receiving the ASR.

What happens when a audit is challenged?

- The ABCRC Agent will arrange a time for the audit challenge.

- A depot can have a representative attend the recount at the ABCRC plant. If no one is able to attend the recount, the depot can ask the ABDA if a staff member is available. In some situations, the BCMB staff are able to attend a recount on a depot’s behalf.

- The shipping container that is being recounted will be segregated until the recount. The containers will be recounted and the recount will be recorded. The new count, if different from the first count, will be registered as the final count and will be applied to the depot payment.

To contact a BCMB Compliance Officer, click on the link below:

Point of Return

Effective December 31, 2020, Depots handling six (6) million containers per year or more must have an approved Point of Return (POR) software system in use in their Depot.

A POR system can be purchased from any vendor but must have the following basic functionality to qualify as meeting the industry standard and be approved for use:

- Each counting station must have individual customer facing screens, unless otherwise approved in writing by the BCMB.

- Each screen must display orders as they are counted, including the number of beverage containers at each refund rate and the total refund payable to the customer.

- Customer-facing stations must match the number of counting stations reported on a Depot’s Uniform Code of Accounts (UCA).

- A receipt must be produced that meets the minimum cash register receipt requirements as outlined in the Depot By-law.

- An industry standard R-Bill that meets the requirements specified in Schedule “E” of the Service Agreement must be produced and transmitted in print and electronically.

- The POR must be able to connect to the Internet.

- The POR must have the ability to track customer orders that are dropped off to be counted and paid at a later time.

All newly established Depots, regardless of volume, must have a POR that meets the industry standard POR requirements.

The expectation with a newly established Depot is that the operator must have the POR installation included in the construction timelines within the Depot Permit Application. The POR would have to be installed prior to an operating permit being issued by the BCMB.

Appealing a Compliance Fee

A Notice of Appeal is to be completed and submitted to the BCMB when a Depot wishes to appeal a compliance fee for one or more of the following reasons:

- The BCMB did not have the authority to issue the notice of compliance fee;

- The BCMB failed to follow its own procedures, and that this failure had, or may reasonably have had, a material effect on the decision to issue the notice of compliance fee;

- The issuance of the notice of compliance fee was influenced by bias;

- The BCMB failed to consider relevant information or took into account irrelevant information in issuing the notice of compliance fee.

Compliance fees must be appealed within 30 days of the date the notice of compliance fee is deemed to have been received by the person who is appealing.

If you have received a compliance fee and wish to appeal it for one or more of the above reasons, you must submit the Notice of Appeal Form below to the BCMB: